By Daniel English-Brown, 3rd Year Physics with Theoretical Physics BSc

Studying, socialising, exercising and now spending – there is a lot you need to balance as a student, especially in London. I will be providing some insight on the latter (tips and tricks, if you will) and the rest I will leave to others. First, who am I speaking to?

Everyone. Yes, even the multimillionaires should be conscious and prudent in their spending. Not only is budgeting a skill, but it could arguably be called a virtue. Perhaps theologians and philosophers in the audience will quibble and say frugality only becomes a virtue when it is a choice or, at least, an outcome you humbly accept. We do not have that luxury. In any case, join me in my guide to getting you from financial wreck to saving superstar.

TIP NUMBER 1: Create a budget

Creating a budget is easier said than done and it is also heavily dependent on the person’s individual circumstances: salary, rent, area in which you live, sports memberships, etc. I will endeavour to give general guidelines that can be used by virtually anybody in their own budget.

First, we need a platform to create your budget on. Many people will use financial saving apps, such as Snoop, however I find it much more beneficial to write out your budget yourself and update the damage done each week. This creates accountability. It is easy to divorce yourself from the feeling of dread that comes as you have to type out each pound spent on that outfit you know you didn’t need but oh-so wanted, when an app does it for you. There are few options for you in that case GoogleDocs, Notes, Evernote but the best has to be Excel.

Excel seems to be the industry standard used often by accountants and professionals, so why not you? It is fairly simple to use and with the creation of a few formulas it saves you the hassle of having to add all your spending yourself. However, for those less technical among you, GoogleDocs is more than sufficient – just come equipped with a calculator!

Okay, so you have chosen your platform for your budget, now what? Start by creating broad sections that you know you purchase items under, roughly, every week. Common items include: shopping (clothes etc.), groceries, subscriptions, transport, eating out, gifts. Add to this list as you see fit and do not forget to have a Miscellaneous column for all those ad hoc and random expenses you cannot quite place.

Create a “Cashflow Out” table (and a “Cashflow In” table if you have a salary) with all your various columns and divide it into 4 weeks (“Week 1” – “Week 4”): how you do this is up to you. Above “Week 1” and below the first row with all your spending brackets, input a row entitled “Ideal Week”. This signifies an ideal week of spending, such that if you match this or go below it, you will be on track for your saving goals.

Now you need to calculate how much you would ideally spend in a week. This may be dependent on several factors: if you have taken out a loan, how much do you have and how long does that need to last you until your next stipend? Will you be working part-time and can buttress your acceptable spending limit a bit? After you roughly know what boundaries you are working within, track your spending per week of the last month or two with respect to each of the categories of spending you have. Average out these amounts and see if by following them you would make it to your next stipend, for example, or not.

If not, then this is where the tough gets going: you need to make sacrifices. If you are going out everyday and you can’t afford it: stop that. If you are going on weekend shopping trips with the girls and it is eating into your savings: stop that.

Now that you have your “Ideal Week” row set up, you can start filling out your spending. My advice would be to do it at the end of each week and stick to it, so that you create a habit plus improve your financial discipline and awareness – do you have enough money to buy this thing? Well now you know because you will have always done your budget within a week.

TIP 2 – Money Savers

Luckily, there are ways to efficiently reduce your spending without reducing your cost of life. Here are a few ideas that may or may not be applicable to you.

Buy a bike. Daily commuters spend a lot of money throughout the week on transportation and while focusing on each individual day the amount may only be £6.50, zooming out to a year’s worth of travelling equates to £2372.5. That is a lot! True, you will need to spend at least £60 for a semi-decent bike, but you would more than make your money back in just 10 days. Not to mention the added physical and mental benefits of cycling daily.

Do meal prep. Constantly eating out and buying just enough food to cook one meal is a sure fire way to blow through your budget very quickly. Instead, get organised one day of the week and do all the grocery shopping you might need for that week. With this food, do a cooking marathon and try to cook as many meals as possible. Not only will this save you money but also time – doing one big cook takes a lot less time than seven mini ones.

Plan your spending trips. If you want to go out and eat at a nice restaurant with your friends or a significant other, then plan this out such that you are only going out to as many a week as you can reasonably afford. The same, of course, applies to shopping trips.

Stick to the budget. This is really important. Think of this as investing in your financial future. One day, after graduation you might get married and have kids, and this means that you have dependents who rely on you to be financially secure. Trust me, this will save you stress and headache down the line if you build the discipline now.

TIP 3 – INVEST

This is undoubtedly my favourite tip. It is a fairly dismal way of life to just slowly watch the money in your bank account fade away. Even though you have put barriers using the tips

above to slow the drain, the money will still disappear. How, then, can you counteract this? Invest.

Before I go any further, this is not financial advice but something I do personally – follow at your own risk.

In the short-term you may consider applying for small and low stress jobs that pay well like tutoring (imagine charging £20 each for a 3-person group class, not bad) or being a student ambassador. However, if you are long-term minded – as we all are as budding financial experts – then we need to consider accumulating wealth as best we can.

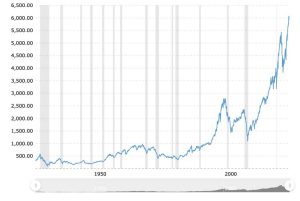

There are several safe and secure ways even for the inexperienced to invest but, by far, the best has to be the S&P 500. For the uninitiated, this is a collection of the 500 largest companies listed in the New York Stock Exchange. Since its inception in 1957, it has increased in value 10.1% per year. The last ten years has seen a 16.6% AER.

Index funds (collections of stocks of different companies) stock prices, like the S&P, compound across time (this could be in the positive or negative direction). This means the longer you leave the stock untouched the more it will increase in value. Here is an example: say you invested £100 when the S&P 500 was created and invested every month £100 while the stock price increased on average by 10.2% each year then you would be sitting on a fortune worth £11,176,108.02. Granted, you would need to take into account inflation but that is still a hefty sum. Of that, £11,094,480,02 was interest (value added to your investment) and of that over half came in the last six years. Thus, the longer you leave it, the happier you will be.

I could go on and on for many pages about the S&P, however in the interest of time and space, I will leave you to your own devices to research and assure yourself that it is a good long term investment.

So there you have it. Now you are armed with the tools necessary to not only survive in London but thrive. Soon you may have to feign understanding when your friends complain about how expensive London is and how they simply cannot cope. Perhaps you will be the one to begin their financial education.

The views expressed herein are not to offer financial advice and guidance but offer the opinion of the individual writing.

Leave a Reply